In Simple Terms Explain the Different Financing

Time for which it is borrowed T 1 year. Loan Repayment With Project Cash Flow.

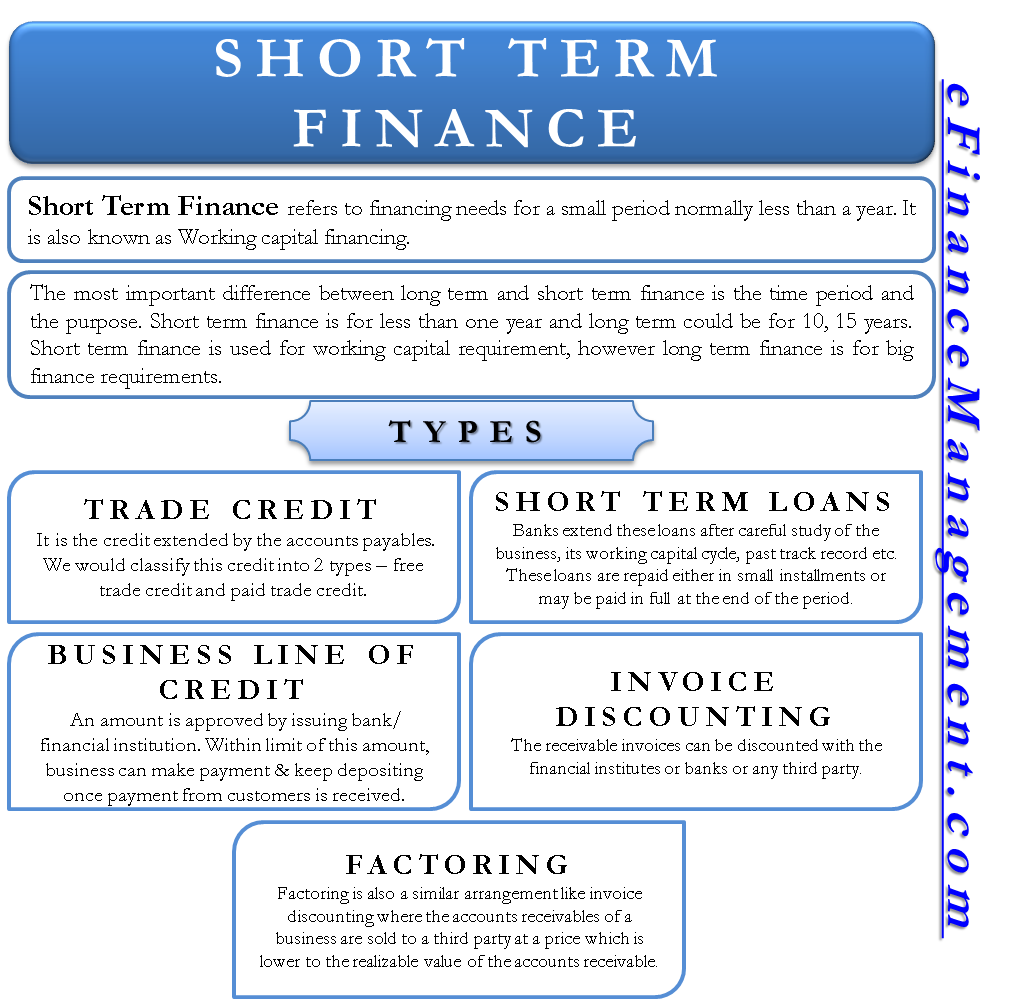

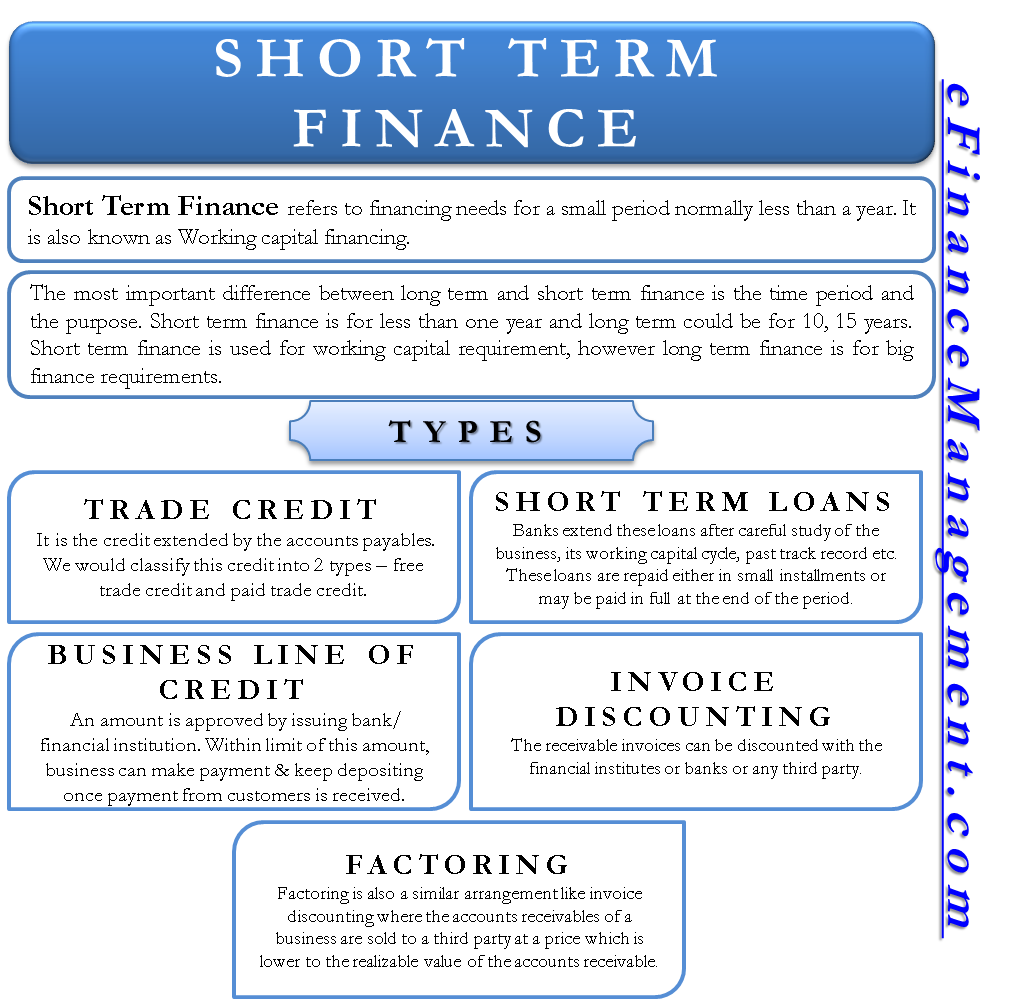

Short Term Finance Types Sources Vs Long Term Efinancemanagement

It works like a contract between two parties which states that a specific underlying can or must be sold on a certain date at a price agreed in advance.

. Here the loan sum P Rs 10000. Or we can say it is the mix of debt and equities that a company uses to finance its assets and manage its day-to-day operations. Amount that Rishav has to pay to the bank at the end of the year Principal Interest 10000 1000 Rs 11000.

Short-term financing means business financing from short-term sources which are for less than one year. The same helps the company generate cash for working of the business and for operating expenses which is usually for a smaller amount. 20000 x 08 x 2 3200.

A loan is something that is borrowed often money which has to be paid back with interest See 5 below. Your APR is shown as a percentage and includes fees and costs related to the loan. An underlying can be a share or a raw material for example.

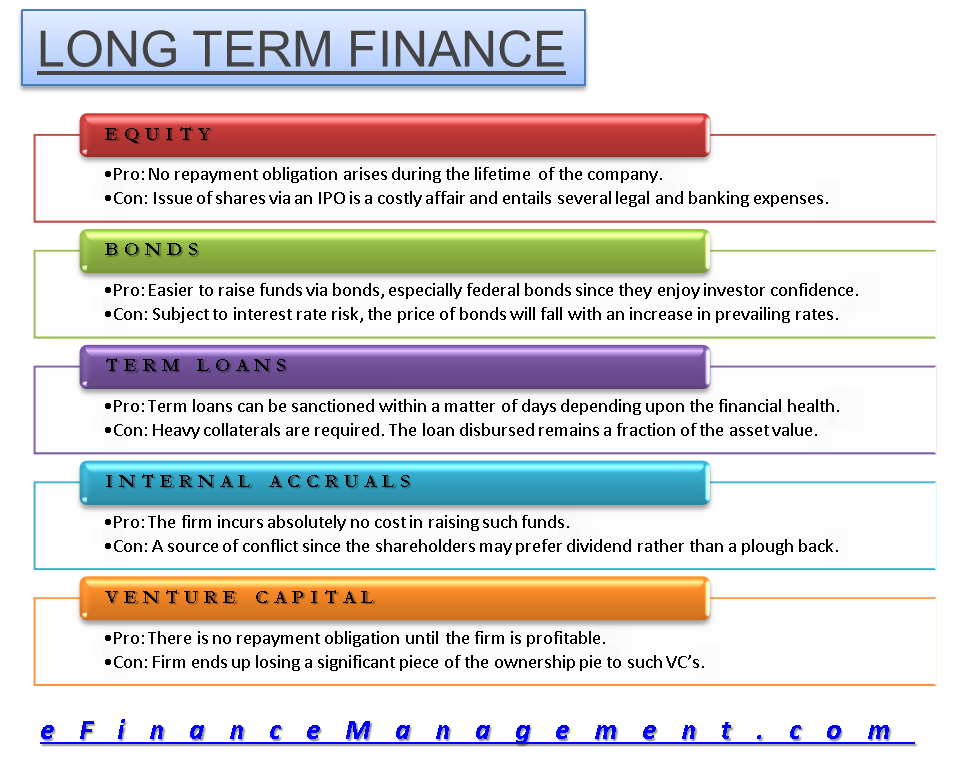

Equity financing uses an investor not a lender. One loan may be manageable but add a house loan two car loans student loans and a few credit card advances into the mix and the interest can get out of control very quickly. There are three main types of finance.

Common Finance Terms Every Newbie Needs to Know. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. This article is an attempt to create a glossary of financial terms which is both compact as well as comprehensive.

These fees and costs will vary depending on the type of product youre applying for ie. Home loan auto loan etc but here are a few examples of fees that are usually included in the APR. Fund manager - A person who manages a mutual fund and tries to maximize funds returns while sticking to funds objectives.

Angel investors move fast and want simple terms. 3 Simple Steps to Building Wealth. A derivative is a financial instrument.

Floating rate - Rate of interest which changes with change in market rate. 1 personal Personal Finance Personal finance is the process of planning and managing personal financial activities such as income generation spending saving investing and protection 2 corporate Corporate Finance Overview Corporate finance deals with the capital structure of a corporation including its funding and the actions. It might make sense to consolidate multiple other loans into a single loan if you can get a lower interest rate than what youre currently paying.

Gross Profit Gross profit is the. It involves developing money by online loans lines of credit and invoice financing. A contract can also be concluded for more than one underlying.

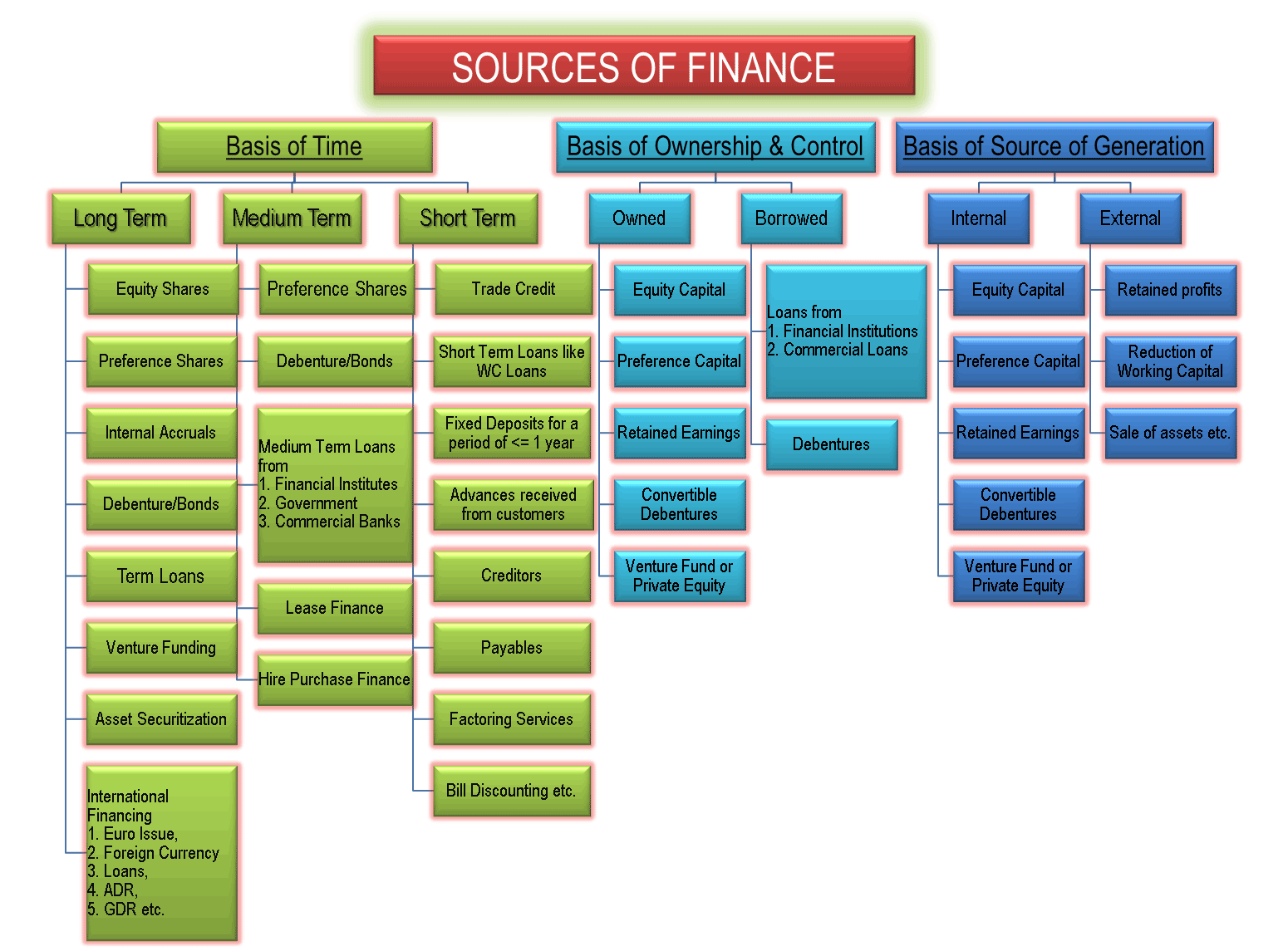

The debt and equity that make up the financial structure are short-term debt long-term debt short-term liabilities and owners equity. This financial glossary gives better more precise and simple-to-understand meanings of financial terminology. Rate of interest per year R 10.

The Financial structure is how a company finances its assets and operations. Youd have the loan paid off in 15 fewer years. Simple interest loan example On a two-year loan of 20000 with an annual interest rate of 8 percent the simple interest is calculated as follows.

Finding an integrated list of financial terms and definitions is only comprehensively possible with the aid of a financial dictionary. Thus simple interest for a year SI P R T 100 10000 10 1 100 Rs 1000. According to the terms of the loan in Project Financing the excess cash flow received by the project should be used to pay off the outstanding debt received by the borrower.

Most kids get the basic concept of a loan because chances are at one. The other method simple interest applies interest only to the initial amount of money borrowed or deposited. For example you might want to refinance a 30-year home loan into a 15-year home loan that comes with higher monthly payments but a lower interest rate.

If you end up in bankruptcy you do not owe anything to the investor who as a part owner of the. Flat rate - Rate of interest in a contract which remains same irrespective of market rate in future. The promissory note also details the loan interest rate the repayment terms the amount borrowed and finally any late fees if the loan.

One method of assessing interest is called compound interest and it consists of periodically applying a percentage rate of interest cost to an initial sum of money as well as the accumulated interest. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits. As the debt is gradually paid off this will reduce the risk exposure of financial services company.

In simple terms its the cost of borrowing the money.

Long Term Finance Equity Bonds Term Loans Internal Accruals Venture

Sources Of Finance Owned Borrowed Long Short Term Internal External

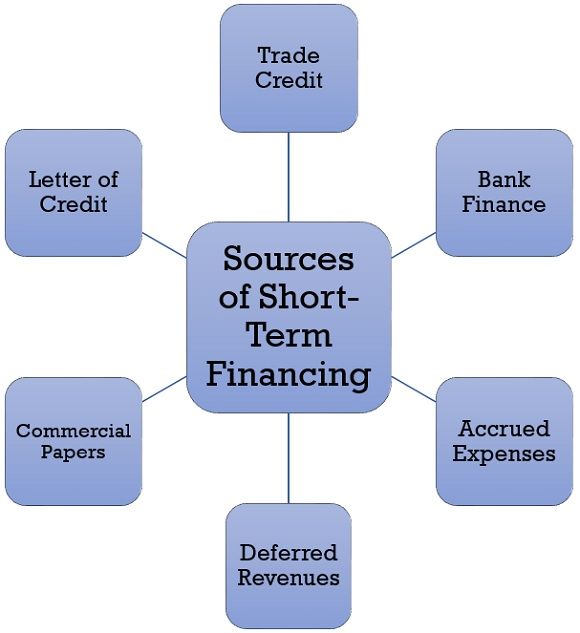

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

No comments for "In Simple Terms Explain the Different Financing"

Post a Comment